Originally Published in Flourishing July/August 2010

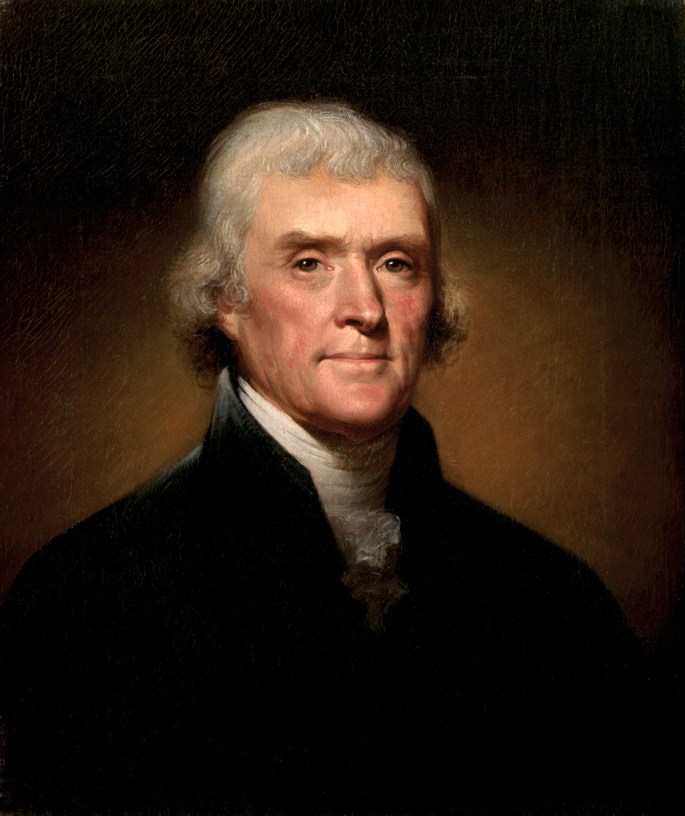

“To take from one, because it is thought his own industry and that of his fathers has acquired too much, in order to spare to others, who, or whose fathers, have not exercised equal industry and skill, is to violate arbitrarily the first principle of association, the guarantee to everyone the free exercise of his industry and the fruits acquired by it.”

—Thomas Jefferson, letter to Joseph Milligan, April 6, 1816.

Larry Summers served briefly as a Secretary of the Treasury under President Clinton, and later as President of Harvard University, where he got into trouble for inadvertently hinting that boys might have a greater natural aptitude for math and science than girls. He is now a key, behind-the-scenes economic advisor to President Obama, having lost out to Tim Geithner as Obama’s Treasury Secretary.

In a New York Times article, The Return of Larry Summers, published on November 26, 2008, David Leonhardt told his readers about one of Summers’ favorite economic arguments: Require every household in the top 1% of American income earners, who as a group have an average annual income of $1.7 million, to write a check for $800,000. This money could then be pooled and used to mail a $10,000 check to every household in the bottom 80 percent of income distribution, those making less than $120,0001.

Leonhardt’s story may only be symbolic, but it is instructive. I see several problems with Summers’ idea.

First is the fact that the $1.7 million is an average. Many households earning less than $500,000 are also in the top 1%. The threshold income to be in the top 1% was $410,096 in 2007, the latest year for which data is available2. Their tax rate would not be the roughly 47% envisioned by Mr. Summers; it would approach 195%. (It’s an important fact, too, that the makeup of the top 1% is constantly changing, as people with new ideas and special talents migrate from the lowest levels of income distribution to the top.)

Second, I believe that Mr. Summers is advocating government-sponsored armed robbery on a heroic scale. I suspect that many among the top 1% might resist having their earnings from whatever source – intellectual and artistic endeavors, business interests, professional practices, or investment, for example – snatched so imperiously. After all, does Summers’ proposal differ in any basic respect from private citizens taking the matter of income inequality into their own hands? It’s probably true that rich people won’t draw their six-shooters to defend their income from the government, but they might well vote with their feet. Talent and Capital tend to reside where they’re treated best.

Third, it’s widely known that Warren Buffett, the world’s third richest man, is very conservative in his personal spending habits, as was Sam Walton, the founder of Walmart.3 Those two may be exceptions of a sort, but the few hundred mansions, yachts, and airplanes belonging to others among the top 1% pale into insignificance alongside the total consumption of the general population. Moreover, a significant portion of the consumption of the wealthy, who are so often demonized as greedy fat-cats, takes the form of support for universities, hospitals, research facilities, theater and music companies, museums, libraries, and churches; to name just a few of their non-profit pursuits.4

Finally, contrary to the myth of conspicuous consumption, most of the wealth owned by the top 1% is held in the form of business, financial, and industrial assets.5 The wealthy and their productive capital can serve consumers throughout the world by producing a vast array of goods and services, or by financing that production, or by paying the wages, salaries, and benefits of a substantial percentage of America’s workforce. The intended beneficiaries of Summers’ scheme should already enjoy a magnificent range of benefits derived from the savings and investments of all Americans, including the invested wealth of those at the top.

I believe that widespread understanding of this issue is critical for America’s return to lasting prosperity; and that economists like Larry Summers and politicians like Barack Obama simply do not appreciate (or care?) that their redistribution policies may limit the formation of productive capital and the creation of well-paying, private-sector jobs. The history of forced wealth and income redistribution is replete with examples.6

In my opinion, Summers’ favorite economic argument does not really benefit the bottom 80%. Rather, forced redistribution of wealth and income consumes the savings and capital of America’s most productive citizens, or drives it and them offshore. My reading of history indicates that such policies have no lasting beneficiaries, only victims. And, most importantly, I believe Thomas Jefferson observed correctly that the forced redistribution of wealth and income is a first-order violation of human rights. mh

1 http://georgereismansblog.blogspot.com/.

2 http://www.ntu.org/tax-basics/who-pays-income-taxes.html.

3The World’s Billionaires, Forbes Fact and Comment, March 10, 2010.

All the Money In the World, Peter Bernstein (editor), Knopf, 2007.

4 Caroline Bermudez, “Wealthy Are Making Bigger Gifts to Charitable Causes”, Chronicle of Philanthropy, July 1, 2010. (http://philanthropy.com/article/Wealthy-Are-Making-Bigger/66112/).

5http://sociology.ucsc.edu/whorulesamerica/power/wealth.html

6 The Ascent of Money: A Financial History of the World, Niall Ferguson, Penguin, 2009.